Notice on the 2023 International Workers Day Holiday Arrangements

CFFEX Notice〔2023〕 No.28

All member entities,

According to the Notice on Market Close for Certain Public Holidays 2023 and Measures of China Financial Futures Exchange on Risk Control, China Financial Futures Exchange hereby announces the following arrangements during the 2023 International Workers' Day holiday.

1. Market Close

In observance of the International Workers' Day, the market will be closed from April 29, 2023 (Saturday) to May 3, 2023 (Wednesday).

The market will remain closed on April 23, 2023 (Sunday) and May 6, 2023 (Saturday).

The market will resume trading on May 4, 2023 (Thursday).

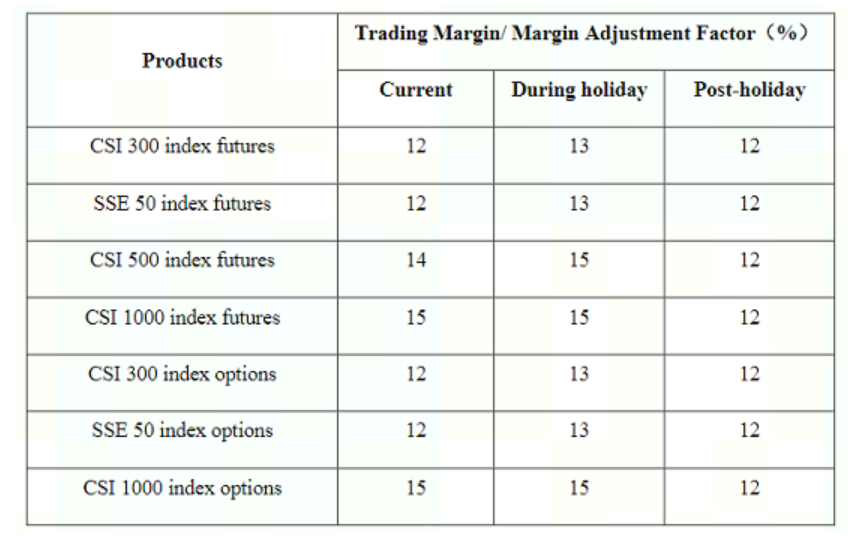

2. Adjustments to trading margin during the International Workers' Day holiday 2023

(1) From the settlement on April 27, 2023 (Thursday), the trading margin of CSI 300 index futures, SSE 50 index futures and CSI 500 index futures will be adjusted to 13%, 13% and 15% respectively.

(2) After trading resumes on May 4, 2023 (Thursday), from the settlement on the first trading day without occurrence of One-Sided Market in the contract with the largest open interest of such product, the trading margin of CSI 300 index futures, SSE 50 index futures, CSI 500 index futures and CSI 1000 index futures will be adjusted to 12%.

(3) The margin adjustment factor of CSI 300 index options, SSE 50 index options and CSI 1000 index options will be adjusted according to the trading margin of corresponding index futures.

Table: Adjustments to trading margin during the International Workers' Day holiday 2023

With the holiday approaching, all member entities are required to strengthen risk management and client service, inform clients of relevant arrangements and potential risks, enhance management of client funds, so as to guarantee the stable and safe functioning of the market. All member entities shall continue to enhance operational safety, identify and prevent risks related to system operations and network security, strengthen monitoring and inspection of the IT system and take measures to guarantee system maintenance and network security, so as to ensure stable system operations during the holiday and be prepared for the orderly resumption of post-holiday trading with system readiness and sound business arrangements.

Member entities shall timely report to the Exchange in case of any emergency or risk event.

Please contact

+86-21-50160801 for trading-related questions

+86-21-50160263 for clearing-related questions

+86-21-50160311 for surveillance-related questions

+86-21-50160508 for IT-related questions.

Comments

Post a Comment